Get Your Federal Tax ID

Lesson 11 from: Launch a Successful Photography BusinessPhilip Ebiner, Will Carnahan

Get Your Federal Tax ID

Lesson 11 from: Launch a Successful Photography BusinessPhilip Ebiner, Will Carnahan

Lessons

Chapter 1: Introduction to Starting a Photography Business

1Welcome

02:26 2Why Do You Want to Start a Photography Business

04:40 3What Kind of Photography Business Do You Want to Start

05:38 4Important Personal Note from Instructor Will

02:25 5Case Study Starting a Photography Business

07:43 6Quiz - Chapter 1

Chapter 2: Basics of Starting a Photography Business

Introduction to Basics of Starting a Photography Business

00:52 8Choose Your Business Name

05:29 9Choose Your Business Structure

06:12 10Register Your Business Name

01:47 11Get Your Federal Tax ID

01:39 12Get Your Business License

01:16 13Get Your Business Bank Account

02:16 14Register Your Online Accounts

02:17 15Branding Your Business

02:18 16Set Your Prices

12:56 17The Photography Gear You Need to Start a Business

03:42 18Case Study - Business Basics

24:42 19Case Study - Equipment

10:05 20Quiz - Chapter 2

Chapter 3: Get Your First Paying Clients

21Intro to Getting Your First Paying Clients

00:44 22You Need to Prove Yourself

01:30 23The Best Place to Find Your First Clients

02:36 24What to Charge for Your First Clients

02:44 25On Set - Partnering with Other Creatives

01:57 26On Set - Getting Work in a Competitive Environment

02:38 27Use Your First Shoot Wisely

01:20 28Case Study - Getting Your First Clients

07:55 29Quiz - Chapter 3

Chapter 4: Create Your Photography Business Website

30Introduction to Create Your Photography Business Website

01:05 31Why You Need a Website and Platform Options

04:30 32What Needs to Be On Your Website

07:32 33Design the Perfect Portfolio

03:17 34Case Study - Looking at Photography Websites

12:56 35Quiz - Chapter 4

Chapter 5: Expanding Your Online Presence

36Introduction to Expanding Your Online Presence

00:55 37Use Instagram to Grow Your Business

02:29 38Use Facebook to Grow Your Business

01:21 39Get Listed on Google

03:53 40Get Listed on Yelp

03:20 41Get Listed on Review Sites

04:06 42Using Craigslist to Get Work

03:01 43Case Study - Expanding Your Online Presence

13:16 44Quiz - Chapter 5

Chapter 6: The Photography Business Workflow

45Introduction to the Photography Business Workflow

00:54 46Step 1 - Meeting Your Client

03:32 47Step 2 - Booking Your Client

05:53 48Step 3 - The Shoot

02:28 49Step 4 - Editing Your Photos

06:34 50Step 5 - Delivering Your Photos

01:05 51Case Study - Business Workflow

15:54 52On Set - the Shoot

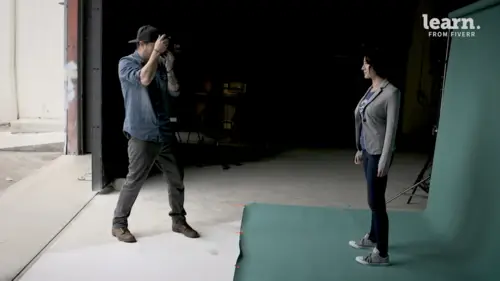

02:50 53On Set - Backdrop Placement

01:13 54On Set - Paper Backdrop Rolls

02:01 55On Set - The Back Light

00:46 56On Set - Interacting with Clients

04:58 57Quiz - Chapter 6

Chapter 7:Scaling Your Business with Better Infrastructure

58Intro to Business Infrastructure and Continued Growth

00:46 59Productivity Tools to Make Your More Efficient

06:21 60Get Business Insurance

03:55 61Accounting Tools & Tips

04:20 62Business Tax Tips

03:38 63Scaling Your Prices Up

02:56 64Use Conventions and Meet Ups to Grow Your Business

04:01 65Case Study - Business Growth

11:04 66Quiz - Chapter 7

Chapter 8: Selling Your Prints

67Intro to the Selling Prints Section

00:56 68Why Should You Sell Your Prints

02:18 69Choose a Printer

02:59 70How to Price Your Prints

05:33 71Selling Your Prints Online

08:06 72Selling Your Prints in Person

02:38 73Wrapping up This Section

01:26 74Quiz - Chapter 8

Chapter 9: Conclusion

75Tips for Personal and Creative Well Being

04:38 76Conclusion

01:45Final Quiz

77Final Quiz

Lesson Info

Get Your Federal Tax ID

So federal and state tax I. D. S. Now this is an I. D. Given to you also known as an E. I. N. Or an employee identification number given to you by in our example by the United States, federal government. It allows you to pay business taxes with that specific tax ID versus your Social Security number. Again, this is another example of us separating you as a person and the business as an entity. Um I also use my E. I. N. Number or my business tax I. D. To pay other people because you're gonna, if you end up hiring assistance, so you end up hiring a second shooter and you start paying them a certain amount of money in your region. You'll have to issue them more tax documents. And so everything will be done under the federal I. Of that number versus your Social Security number. So your new business will have a federal and state tax I. D. And that's the number that you're going to use to not only pay taxes but you also need that to set up a bank account for your business. The bank will not ...

open a separate business account if you're a business without a tax idea. So basically think about it as a Social Security number for your business, your business, it's its own person and has its own Social Security number. It's called the Federal Tax ID. And usually this is issued to you once all your paperwork has gone through and you've been approved, they'll mail it to you. Um You can also go to the I. R. S. Website in the United States and you can look up how to apply for that for free. Um Again very different in every city, state and region across the world. For the United States, we will include a link in our description on the worksheet for you to get to that.

Class Materials

Bonus Materials with Purchase

Ratings and Reviews

Andrew Pilecki

Student Work

Related Classes

Business