Business Tax Tips

Lesson 62 from: Launch a Successful Photography BusinessPhilip Ebiner, Will Carnahan

Business Tax Tips

Lesson 62 from: Launch a Successful Photography BusinessPhilip Ebiner, Will Carnahan

Lessons

Chapter 1: Introduction to Starting a Photography Business

1Welcome

02:26 2Why Do You Want to Start a Photography Business

04:40 3What Kind of Photography Business Do You Want to Start

05:38 4Important Personal Note from Instructor Will

02:25 5Case Study Starting a Photography Business

07:43 6Quiz - Chapter 1

Chapter 2: Basics of Starting a Photography Business

Introduction to Basics of Starting a Photography Business

00:52 8Choose Your Business Name

05:29 9Choose Your Business Structure

06:12 10Register Your Business Name

01:47 11Get Your Federal Tax ID

01:39 12Get Your Business License

01:16 13Get Your Business Bank Account

02:16 14Register Your Online Accounts

02:17 15Branding Your Business

02:18 16Set Your Prices

12:56 17The Photography Gear You Need to Start a Business

03:42 18Case Study - Business Basics

24:42 19Case Study - Equipment

10:05 20Quiz - Chapter 2

Chapter 3: Get Your First Paying Clients

21Intro to Getting Your First Paying Clients

00:44 22You Need to Prove Yourself

01:30 23The Best Place to Find Your First Clients

02:36 24What to Charge for Your First Clients

02:44 25On Set - Partnering with Other Creatives

01:57 26On Set - Getting Work in a Competitive Environment

02:38 27Use Your First Shoot Wisely

01:20 28Case Study - Getting Your First Clients

07:55 29Quiz - Chapter 3

Chapter 4: Create Your Photography Business Website

30Introduction to Create Your Photography Business Website

01:05 31Why You Need a Website and Platform Options

04:30 32What Needs to Be On Your Website

07:32 33Design the Perfect Portfolio

03:17 34Case Study - Looking at Photography Websites

12:56 35Quiz - Chapter 4

Chapter 5: Expanding Your Online Presence

36Introduction to Expanding Your Online Presence

00:55 37Use Instagram to Grow Your Business

02:29 38Use Facebook to Grow Your Business

01:21 39Get Listed on Google

03:53 40Get Listed on Yelp

03:20 41Get Listed on Review Sites

04:06 42Using Craigslist to Get Work

03:01 43Case Study - Expanding Your Online Presence

13:16 44Quiz - Chapter 5

Chapter 6: The Photography Business Workflow

45Introduction to the Photography Business Workflow

00:54 46Step 1 - Meeting Your Client

03:32 47Step 2 - Booking Your Client

05:53 48Step 3 - The Shoot

02:28 49Step 4 - Editing Your Photos

06:34 50Step 5 - Delivering Your Photos

01:05 51Case Study - Business Workflow

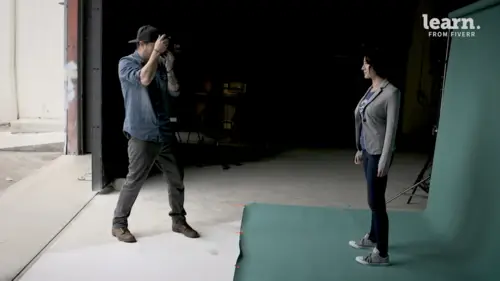

15:54 52On Set - the Shoot

02:50 53On Set - Backdrop Placement

01:13 54On Set - Paper Backdrop Rolls

02:01 55On Set - The Back Light

00:46 56On Set - Interacting with Clients

04:58 57Quiz - Chapter 6

Chapter 7:Scaling Your Business with Better Infrastructure

58Intro to Business Infrastructure and Continued Growth

00:46 59Productivity Tools to Make Your More Efficient

06:21 60Get Business Insurance

03:55 61Accounting Tools & Tips

04:20 62Business Tax Tips

03:38 63Scaling Your Prices Up

02:56 64Use Conventions and Meet Ups to Grow Your Business

04:01 65Case Study - Business Growth

11:04 66Quiz - Chapter 7

Chapter 8: Selling Your Prints

67Intro to the Selling Prints Section

00:56 68Why Should You Sell Your Prints

02:18 69Choose a Printer

02:59 70How to Price Your Prints

05:33 71Selling Your Prints Online

08:06 72Selling Your Prints in Person

02:38 73Wrapping up This Section

01:26 74Quiz - Chapter 8

Chapter 9: Conclusion

75Tips for Personal and Creative Well Being

04:38 76Conclusion

01:45Final Quiz

77Final Quiz

Lesson Info

Business Tax Tips

let's talk about everyone's favorite subject taxes. So I know I briefly mentioned it in the previous lesson about saving for taxes, but taxes are a part of everyone's life, especially people who have and run their own businesses, We keep mentioning this, but depending on where you live, your state, your city, your country taxes are going to look different for everyone. The percentage that's collected when it's collected, how you make those payments. Again, it's going to be different. So it's important to find an accountant who can help you with this in your local area to talk to other photographers in your area to see how it works for them. If you're just getting started, The main thing to understand is that you have to pay taxes on any income that you make. So it's a good idea to estimate what percentage you need to save so that you can keep that in your bank account or even a separate bank account so that you can make those payments from that account and not have to worry about where...

you're gonna come up with the money for paying your taxes. Do not fall into the trap of not knowing how much you owe and spending all your money that you're making. Because if you're running a legitimate business, you need to be paying taxes and know how much you owe. Another thing that will mentioned briefly in the last section was sales tax. This is again gonna change depending on what region you're in, what kinds of things you're selling. But if you're selling things like physical goods, if you're selling at the local market Prince, you might have to charge sales tax that go to your local government to your state. So again, something you have to look into and you add that sales tax on the top of any prices you charge and you have to save that money and send it back to the government with taxes. I also want to just mention that the good thing is that if you have expenses as a business, those are usually tax deductible. So things to keep in mind are of course your equipment. So if you're buying a new camera gear, this is gonna be deductible if you're running an actual photo business, travel costs such as mileage or lodging. If you have to stay somewhere that's also going to be deductible meals depending on what it's for during a shoot partially can be deducted as well. Again, going to be different wherever you live though. Also, if you have a home based office, some of your home office expenses can be deducted. Generally things like your internet or even your other utilities, electricity, water, those things can be partially deducted if you are working from home. It's important though to talk to an accountant to find out what is actually available to be deducted in your area. one thing you should consider though is because you might have to pay a lot of taxes on the income is should you be paying that in taxes or maybe is it a good idea to invest that? Reinvest it in your business with things like better equipment or bulking up your website, advertising, promotional costs, those kinds of things. This is something that maybe at the end of the year and you look back and see how much you've made and see if you've had enough expenses or what your taxes are going to look like and you have to make that judgment call on if it will be better for you to reinvest in your business or not. So that's a little bit about taxes. I know it's not the best subject that everyone likes to talk about and again, talk to an accountant in your area to help you out with your own situation.

Class Materials

Bonus Materials with Purchase

Ratings and Reviews

Andrew Pilecki

Student Work

Related Classes

Business